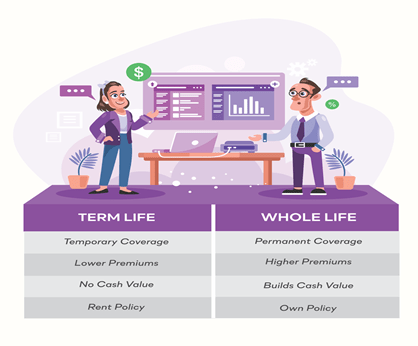

Term Life

Term life policies are typically more affordable than permanent policies because term life coverage is temporary and does not accrue cash value. Term policies may be a good fit for parents or for spouses who want to ensure the financial security of their dependents during a critical time in their life, such as paying a mortgage or paying for a child’s education.

Permanent Life

Permanent life insurance provides lifetime coverage (as long as you pay your premiums on time) and includes a cash value component that is not offered by term life policies. You can borrow against the cash value of the policy or collect it when the policy is surrendered. A permanent policy may be a good fit for someone who wants lifetime coverage and is interested in the investment vehicle it offers.